October 2024 – Beneficial Ownership Information (BOI) Reporting Update

Beneficial Ownership Information (BOI) Reporting Update

OVERVIEW

Effective January 2024, new requirements were rolled out for Beneficial Ownership Information (BOI) reporting. We would like to follow up on our previously issued newsletter to share a reminder and a link to a BOI reporting video FinCEN published which shows how to file the Beneficial Ownership Information Report (BOIR).

NEW REPORTING RULES

As a reminder – the Financial Crimes Enforcement Network (FinCEN) introduced new guidelines for BOI reporting to ensure transparency and integrity in financial transactions.

Effective January 1, 2024, many businesses were required to start collecting and reporting detailed information on their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). Beneficial owners are individuals who directly or indirectly own or control 25% or more of the equity interests in the legal entity or have significant managerial control over the entity.

– Companies created or registered before January 1, 2024, have until January 1, 2025, to file a BOIR.

– Companies created or registered between January 1, 2024, and January 1, 2025, must file BOIR within 90 days of receiving notice that their registration is effective.

– Companies created or registered on or after January 1, 2025, must file BOIR within 30 days of receiving notice that their registration is effective.

– Any updates or corrections to previously submitted BOIR must be filed with FinCEN within 30 days.

According to FinCEN, the new reporting requirements are designed to identify individuals who have a significant ownership interest in legal entities, which will help prevent illicit financial activities such as money laundering and fraud.

NEXT STEPS

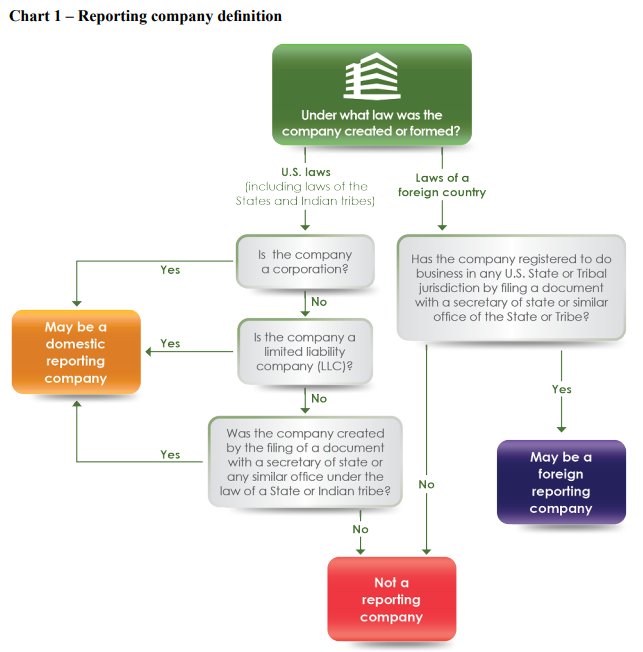

To comply with these new regulations, business owners need to determine if their companies are required to report their beneficial owners, or in other words, if their company is a “reporting company”.

The Financial Crimes Enforcement Network (FinCEN) published a compliance guide which includes the following chart. This chart is an excellent starting point in determining whether your business entity is required to comply with the BOI reporting effective 1/1/2024.

IMPORTANT CONSIDERATIONS

Given the complexities and potential legal implications associated with BOI reporting, we strongly recommend that you consult with your legal attorney to receive expert guidance and advice tailored to your specific situation.

As your CPAs, we will not be undertaking the responsibility of preparing or submitting BOI reports to FinCEN as doing so could be considered unauthorized practice of law. However, we are here to assist you in collaborating with your legal attorney to ensure a smooth transition into BOI reporting compliance.

Please refer to FinCEN’s Frequently Asked Questions page and watch this video for guidance on how to file. Additionally, your legal attorney can offer specific advice for your situation. It’s essential for business owners to have legal counsel to ensure accurate BOI reporting and to handle any potential legal issues.