November 2023 – BOI Reporting

Beneficial Ownership Information (BOI)

Reporting Update

OVERVIEW

As we approach the new year, we would like to inform you about an important update regarding Beneficial Ownership Information (BOI) reporting that will be effective starting on January 1, 2024.

To ensure transparency and integrity in financial transactions, the Financial Crimes Enforcement Network (FinCEN) has introduced new guidelines for BOI reporting. These guidelines aim to enhance the collection and disclosure of information about the beneficial owners of legal entities.

NEW REPORTING RULES

– Effective January 1, 2024, many businesses will be required to collect and report detailed information on their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). Beneficial owners are individuals who directly or indirectly own or control 25% or more of the equity interests in the legal entity or have significant managerial control over the entity.

– Domestic entities formed in the US before 2024 have until 1/1/25 to file an initial report.

– Foreign companies registered to do business in the US before 2024 have until 1/1/25 to file an initial report.

– Entities created or registered after 2023 have only 30 days from the formation or registration date to comply with the reporting requirements.

– To Note: if there are any changes to an entity’s previously reported information, an updated report must be filed within 30 days of the change.

– The new reporting requirements are designed to identify individuals who have a significant ownership interest in legal entities, which will help prevent illicit financial activities, such as money laundering and fraud.

NEXT STEPS

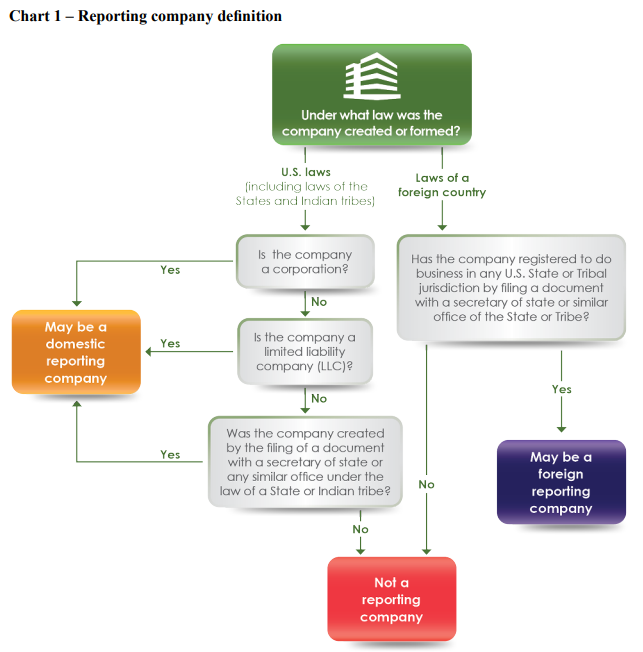

– To comply with these new regulations, business owners will need to determine if their companies have to report their beneficial owners, or in other words, if their company is a “reporting company”.

– The Financial Crimes Enforcement Network (FinCEN) published a compliance guide which includes the following chart. This chart is an excellent starting point in determining whether your business entity is required to comply with the BOI reporting effective 1/1/2024.

IMPORTANT CONSIDERATIONS

– Given the complexities and potential legal implications associated with BOI reporting, we strongly recommend that you consult with your legal attorney to receive expert guidance and advice tailored to your specific situation.

– Your legal attorney will be able to provide you with insights and assistance in understanding the following aspects of BOI reporting as well as the updates effective 1/1/2024:

- Applicability: Determining whether your business entity is subject to BOI reporting requirements based on your jurisdiction and legal structure.

- Compliance: Navigating the legal obligations and specific requirements for collecting and reporting information about beneficial owners, including thresholds, disclosure criteria, and deadlines.

- Privacy and Confidentiality: Ensuring the secure handling and protection of sensitive information related to beneficial owners in accordance with legal and privacy regulations.

- Legal Implications: Identifying potential legal consequences and penalties associated with non-compliance or inaccuracies in BOI reporting.

- Reporting Process: Providing guidance on how to gather and document the necessary information about beneficial owners in a manner that complies with the law.

– As the above aspects are complex, it is crucial to have legal counsel in place to ensure that your BOI reporting process is correct and to address any legal concerns that may arise.

– As your CPAs, we will not be undertaking the responsibility of preparing or submitting the BOI reporting to FinCEN as this could be considered unauthorized practice of law. However, we are here to support you as you work closely with your legal attorney to facilitate a smooth transition into BOI reporting compliance.

ADDITIONAL RESOURCES

– An Introduction to Beneficial Ownership Information Reporting