November 2022 – Series I Bonds

SAVINGS BONDS: SERIES I BONDS

What are Series I Bonds?

Series I Bonds are a type of Savings Bond that can be purchased to protect funds against inflation. These earn you both a fixed rate, established at the time of purchase, as well as a rate based on inflation, compounded semiannually, for up to 30 years and are able to be purchased for as low as $25.

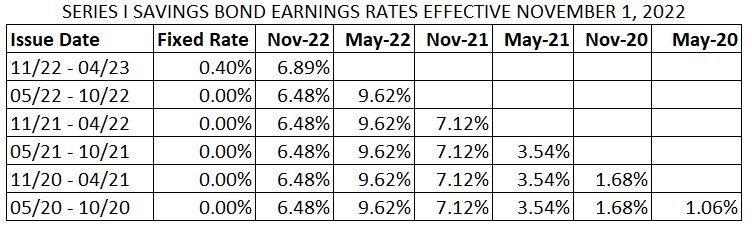

To track inflation, rates are updated every 6 months both in November and May and are guaranteed to never fall below 0%. The current combined rate released November 1, 2022 is 6.89%. See below for a 3 year historical view of I Bonds Earnings Rates:

Note: Interest rates are also increased every six months from the date your bonds are issued. For example, if your bonds are issued in September and the rates are adjusted in November, the rate your bonds are earning will not reflect the new, November, rate until the following March (six months after the September issue date).

I Bonds can be redeemed after 1 year, however, if you choose to redeem any before 5 years you will lose the last 3 months of interest income earned. For Electronic I Bonds you can redeem a minimum of $25 whereas for Paper I Bonds you must redeem the entire value. For Paper I Bonds you can check the current value by visiting TreasuryDirect’s Savings Bond Calculator.

While you will have to pay Federal Income Tax on interest earned, there is no State or Local Income Tax on I Bonds. Depending on circumstances you may be required to pay Federal Estate, Gift or Excise Taxes as well as State Estate or Inheritance Tax. Federal Income Tax can either be reported annually or reported in the tax year of redemption up to its 30 year life, whichever comes first.

Special Note: If you use the money for qualified higher education expenses you may not have to pay tax on the earnings.

Who can Purchase I Bonds?

I Bonds can be purchased for yourself, your child, or as a gift to someone else. They can also be purchased by your business, estate, or trust. Whether it be a Corporation, a Partnership, an LLC, or even a Sole Proprietorship, I Bonds can be purchased under the EIN of the company. While restrictions do apply under User Guide 292 for those who would like to purchase I Bonds under their businesses EIN, this may be another secure way to safeguard long term funds.

How to Purchase I Bonds

While I Bonds are primarily purchased electronically you can also choose to use all or a part of your Federal tax refund to purchase Electronic or Paper bonds.

Electronic I Bonds can be purchased and managed directly from TreasuryDirect once you have created a profile. The maximum you can purchase in a calendar year is $10,000 while the minimum is only $25. The $10,000 maximum is an individual limit and is not affected by however much you may purchase as a gift or for a child. This limit also does not affect your ability to purchase $10,000 in EE Bonds.

Paper I Bonds can also be purchased through filing your Federal Tax Return and submitting Form 8888. This form is used to specify how much of your Federal refund you would like to use to purchase Savings Bonds and how much should be refunded directly to you. By using your Federal Tax refund to purchase Paper I Bonds this allows you to purchase up to an additional $5,000 over the calendar year maximum of $10,000 in Electronic I Bonds with a minimum purchase of $50.

Special Note: Purchasing Paper Bonds every year can be hard to track and maintain so you do have the option to convert Paper Bonds to Electronic Bonds through your TreasuryDirect account.

Conclusion

Series I Bonds are generally a safe and secure place to keep your long term funds and shield against inflation. With many ways to purchase these bonds it comes down to whatever is easiest for you.

For additional information please see TreasuryDirect’s FAQ page for general information and as always, please reach out to us if you have any questions.

EMPLOYEE SPOTLIGHT: TODD WOLF

Todd joined the Soukup, Bush & Associates team in July of 2021. He assists other team members in performing audit & attestation services. He has a background in financial software testing for employee benefit and heath care reimbursement platforms as well as IT management and web development.

Todd moved to Fort Collins from Williamsburg, Virginia with his wife Tara in early 2020. He graduated with honors from Virginia Commonwealth University with a Bachelor of Science in Psychology with a minor in Statistics. He completed his Master of Accounting with a concentration in Audit from the University of North Carolina at Chapel Hill in June of 2021.

When not studying for the CPA exam, he spends his free time hiking, camping, fishing, and skiing with his spouse Tara and his son Benjamin. He is also active in his church community and enjoys improvisational music.