February 2022 – Employee Benefit Plans & Document Retention

EMPLOYEE BENEFIT PLANS & DOCUMENT RETENTION

What documents must you keep to stay in compliance?

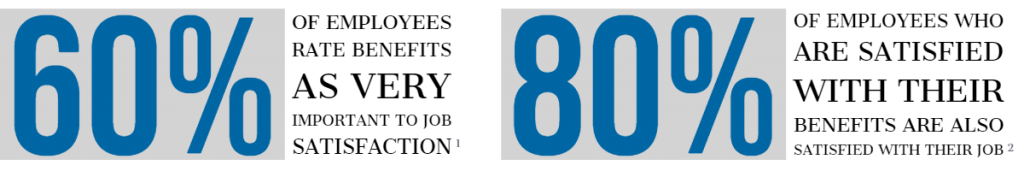

Employee benefit plans, such as retirement and health and welfare plans, are an important tool for employers. In addition to providing valuable benefits beyond monetary compensation, these plans can help attract and retain employees.

Managing employee benefit plans can be difficult, as there are many different regulations that must be followed. The Employee Retirement Income Security Act (ERISA), the Department of Labor (DOL), and the IRS all have specific compliance requirements.

Record retention and the protection of sensitive information are two of the most important requirements for plan sponsors, administrators, and trustees alike. These records can be broken down into the categories below:

Reporting and Disclosure Records include all of the forms filed with government agencies with respect to the plan. This includes Form 5500, nondiscrimination and coverage test results, evidence of the plan’s fidelity bond, and corporate income-tax returns. ERISA requires these documents to be retained for a minimum of 6 years.

Benefits Determination Records include information necessary to determine benefits, eligibility, and investment balances at both the plan and individual participant level. This includes – but is not limited to – census data, participant account records, and documentation relating to plan loans, withdrawals and distributions. Per ERISA, documents at the individual participant level must be retained as long as the participant holds assets within the plan. At the plan level, both the DOL and ERISA recommend that records are kept indefinitely.

- Note: Participant account records discussed above refer to employee data, including date of birth, date of hire, date of termination, Social Security number, hours worked, and pay rate documentation. This information is commonly found on the employee’s I-9 and in other Human Resource documents. Even if a participant is terminated from the company, their employee file should be retained as long as they hold assets within the plan.

Accounting records include information that is used in the calculation, measurement, processing and communication of financial information about the plan. They may be used to confirm the accuracy and completeness of individual participant account and plan financial information, in financial statement preparation, and for determining plan tax qualification status. These documents should be retained for the same amount of time as reporting and disclosure records, a minimum of 6 years.

- Note: Retention of accounting records is especially important if you are subject to an audit under ERISA. ERISA generally requires employee benefit plans with 100 or more participants to have an audit by an independent qualified public accountant. Under these circumstances, an audit report must be attached to Form 5500 in order to file the tax return. The auditors will need to see the accounting records in order to complete the audit and issue an opinion.

Plan governance records include documents that memorialize the plan administrator’s fiduciary decisions. This includes the original plan document, amendments, IRS determination letters, minutes, board resolutions, and written plan policies. Both the DOL and ERISA recommend that these records are kept indefinitely.

Summary

In order to ensure compliance with all above standards, it is best practice to set forth a retention policy in writing. This written policy should govern how and when the organization will review, update, preserve, and discard documents. It is the plan sponsor’s duty to maintain adequate records, regardless of any third-party services used.

Not only must records be kept, but sensitive data must be protected. Safeguarding an entity’s data, both personal and confidential, is a key responsibility of plan sponsors. Share as little data as possible, be careful about viewing sensitive data in public, and properly dispose of documents with personal information. It is also important to remember that sensitive data should never be shared over email.

Proper record retention is essential when operating an employee benefit plan. We recommend reaching out to your ERISA attorney with any questions, as they specialize in these issues.

We provide both limited scope and full scope audit services for employee benefit plans.

Please let us know if you would like more information on these services.

2022 SOUKUP BUSH DEADLINES

MARCH 15, 2022: For our clients with individual and C-corporation tax returns – please provide all documents and required information for individual and C-corporation tax returns by March 15, 2022. In order to provide our best service, your tax return will be extended and completed after April 15, 2022 if there is still outstanding information needed by March 15, 2022.

2022 FILING DEADLINES

FEBRUARY 28, 2022 – Form 1099 MISC and the related Form 1096 must be filed with the IRS for rents, royalties, or other payments (MARCH 31, 2022 if filed electronically)

MARCH 15, 2022 – Federal and state income tax returns are due for calendar-year flow-through entities, including partnerships and S-Corporations

APRIL 15, 2022 – Federal and state income tax returns are due for individual taxpayers, C-Corporations, and Estates and Trusts

SEPTEMBER 15, 2022 – Federal and state income tax returns are due for flow-through entities, including partnerships and S-Corporations if extended

SEPTEMBER 30, 2022 – Federal and state income tax returns are due for trusts if extended

OCTOBER 15, 2022 – Federal and state income tax returns are due for individual taxpayers, and C-Corporations if extended

2022 ESTIMATED PAYMENT DEADLINES

APRIL 15, 2022 – 1st quarter estimated payments for 2022 are due to the IRS and Colorado Department of Revenue

JUNE 15, 2022 – 2nd quarter estimated payments for 2022 are due to the IRS and Colorado Department of Revenue

SEPTEMBER 15, 2022 – 3rd quarter estimated payments for 2022 are due to the IRS and Colorado Department of Revenue

EMPLOYEE SPOTLIGHT: JUSTIN BISHOP

Justin, a native Texan, joined the Soukup, Bush & Associates team in July of 2021. He graduated from Baylor University in May of 2017 with a Bachelor of Arts degree in Arabic and Middle East Studies and from Colorado State University – Global in June of 2021 with a Bachelor of Science degree in Accounting.

Prior to coming to Soukup, Bush & Associates, Justin worked as a Nuclear Missile and Operations Officer at Francis E. Warren Air Force Base in Cheyenne, Wyoming. He separated from the military after four years as a Captain with an Honorable Discharge in 2021.

In his free time, Justin enjoys watching the Baylor and the University of Nebraska football teams and spending time with his wife and baby boy.