December 2022 – Colorado SecureSavings

Colorado SecureSavings Program

An Update

Earlier this year, we reached out to you with a newsletter on the Colorado Secure Savings Program. Now that we are further into the year, we wanted to provide an update on the mechanics of this program as more information has become available.

– The Colorado Secure Savings Portal is now available. Employers can use this portal to register their business or exempt their business.

– Program details are now also available online. Below, we provide a summary of what you need to know.

Refresher

In 2019, the Colorado Secure Savings Board (“The Board”) was created to study the costs Colorado was taking on as a result of insufficient retirement savings. After reviewing the data, the board found that more than 40% of the Colorado’s private-sector workforce did not have access to a retirement savings account or plan at work. In response, the board created the Colorado Secure Savings Program (CSSP), a state-mandated workplace retirement plan. The CSSP is effective starting January 1, 2023, and is a retirement savings program for private sector workers who currently do not have access to a workplace retirement savings plan.

Facts

Who must participate? All qualified Colorado businesses need to participate in the Colorado Secure Savings Program if they:

- have been in business for two or more years.

- have five or more employees.

- do not already offer a retirement plan.

Registration:

- Business owners will be notified through either paper mail or email by Colorado SecureSavings when it is time for them to register.

- It is important for business owners to keep this notice and have it on hand as it will have an access code for them to use during the registration process.

- If a business owner is exempt as they already offer a plan or have fewer than five employees, they will need to let Colorado SecureSavings know through the portal.

- The employee retirement accounts will be set up automatically once the employer registers. The employer is not responsible for retirement account setup or management.

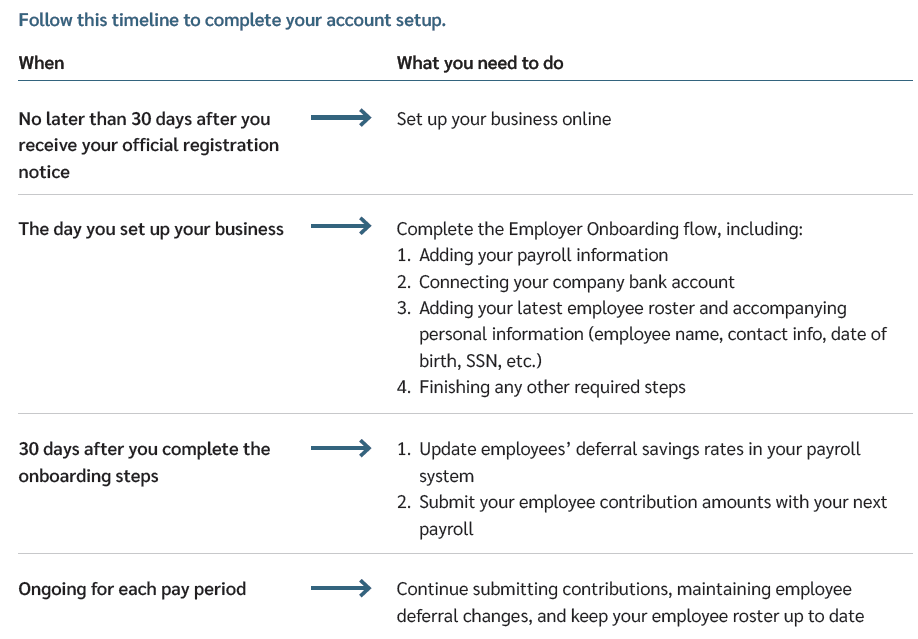

Employer Steps (please see this checklist):

- Register (or submit exemption) in early 2023 using the access code on the notification.

- If registering, upload payroll and other information to the portal as directed in the account setup guide. Please let your payroll provider know if you need assistance with this step. Please feel free to contact us as well if you need some guidance regarding these uploads.

Keep employee records up to date in the portal. This will include submitting payroll details and contribution levels each pay period.

Keep In Mind:

- Employers have 180 days from the date of hire to enroll new employees in Colorado SecureSavings plan.

- This plan is operated at zero cost to the employer, but the employer needs to comply with the setup and enrollment.

- Looking at the IRS definition, employer retirement plans include defined contribution plans such as a 401(k), IRA-based plans such as the SEP or SIMPLE IRA, and pensions. Employers have the option to sponsor one of these types of plans on their own and not use the public state-run program, and must simply file an exemption on the portal to do so.

Conclusion

The Colorado Secure Savings Program was initiated to provide over 940,000 employees in Colorado the opportunity to save for retirement under a structured plan, and it will take effect in 2023. Whether employers are participating or exempt, employers will need to communicate their status to Colorado SecureSavings in early 2023. Employers will receive notices with directions on how to communicate with the Colorado SecureSavings Program regarding their status.

For additional information, please visit the following resources:

Colorado SecureSavings Help Center

EMPLOYEE SPOTLIGHT: CHRYSTAL PRENTICE

Chrystal joined the Soukup, Bush & Associates team in December of 2021. Chrystal has worked in bookkeeping for over thirty years and across several different industries. She was responsible for such tasks at the preparation of financial statements, payroll and payroll tax returns, accounts payable and receivable, and other bookkeeping roles. At the firm, she provides bookkeeping services to clients by preparing monthly financial statements, bank reconciliations, and quarterly and annual payroll tax returns.

Chrystal enjoys spending time with her fiancé at the race track, spending time outdoors and working in her garden.