December 2021 – 1099 Filing Requirements – Important Reminders

1099 Filing Requirements – Important Reminders

As we approach 1099 filing season, we wanted to provide further guidance on our new 1099 preparation process for 2021 forms 1099.

We have started uploading to the portal a form 1099-specific engagement letter and an Excel template with pre-populated 2020 vendor information to assist in updating the template with the relevant 2021 information.

If we prepared your 1099s last year, you should have also received (or will be receiving shortly) an email from us with links to both of these documents and instructions on how to complete the Excel template. If you would like us to assist with the preparation of your 2021 forms 1099 please sign the engagement letter and return to us.

Please reach out with any questions on this new 1099 preparation process.

Helpful Facts

-

1099s are not required to be issued for payments made personally; only payments made in the course of a trade or business require reporting.

-

It is best to ask for a Form W-9 from each non-employee you pay for services. This streamlines the 1099 filing process, as a completed W-9 will indicate if the vendor or contractor actually needs a 1099 issued to them and includes the contractor’s name and business name, type of entity, and the business’ tax identification number. This form is filled out by the independent contractor and retained for your records.

-

1099’s are issued for payments made for services, not goods, $600 or more per payee.

-

Payments to C corporations, S corporations, and LLC’s treated as S corporations for tax purposes are generally not required to be reported on a Form 1099.

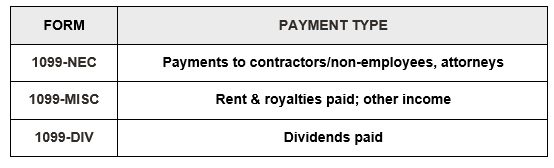

Forms

Your business is required to file a Form 1099 with the IRS and provide a copy to each person or entity to whom you have made certain types of payments. The most common types of payments requiring 1099 filing include the following:

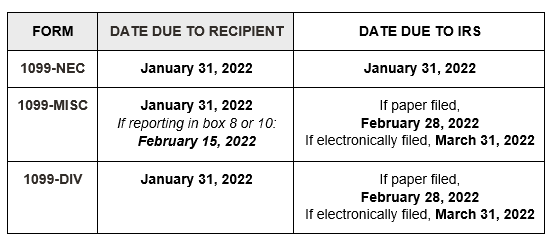

Filing Deadlines

Final Tips

**Extended 1099 Deadline Available:

To ask for an extension on the 1099 IRS filing deadline, a completed Form 8809 must be filed by the original filing deadline. Please note, for the 1099-NEC, no extensions are available. The extension will provide 30 additional days beyond the original filing deadline for each form.

To request an extension of time to furnish 1099s to the recipients, a letter request must be faxed to the IRS including the following items:

-

Payer name

-

Payer TIN

-

Payer Address

-

Form type

-

Reason for extension

Information Needed to File

In order to file your 1099’s, you will need the following information:

-

Name, address, and SSN/EIN of the payee

-

Total amount of payments made during 2021 in each reportable box of the 1099

Penalties for failure to file Forms 1099 can be severe. Depending on how late the corrected filings are made, penalties per incorrect form can range from $50 to $560.

If you would like us to extend and/or prepare 1099’s for your business in the upcoming tax year, please furnish the necessary information to us by January 10, 2022 so we are able to best assist you in meeting the deadlines for these forms.

Please note: if you are on the receiving end of a 1099, please be sure to include it with the documents you send to us to prepare your tax return.

As always, please let us know if you have any questions on the new 1099 process or on 1099 filing requirements.

Savannah Deitchel

Savannah joined the Soukup, Bush & Associates team in July of 2020. She grew up in Washington for most of her life and moved to Colorado in 2012, where she graduated from Front Range Community College in December 2016. She currently assists with all aspects of the administrative position as well as processing both individual and corporate income tax returns. In her spare time, Savannah enjoys spending time with her husband and their two dogs as well as gardening, hiking, traveling, boating, and camping. |