April 2024 – Estate Planning & Trusts

ESTATE PLANNING & TRUSTS

OVERVIEW

Estate planning is a process that involves making arrangements for the distribution of your assets after you pass away. While it may be uncomfortable to think about, taking the time to plan your estate ensures that your loved ones are well taken care of and that your assets are distributed according to your wishes.

One of the ways to ensure your assets are distributed according to your wishes is to set up a trust. In this newsletter, we will explore some options for estate planning that involve different types of trusts to assist in navigating your estate planning.

FACTS & CONSIDERATIONS – TRUSTS

– Trusts are entities that are created to house, manage and distribute estate assets. Trusts can be beneficial for avoiding probate and ensuring a smooth transition of assets.

– There are several types of trusts available for estate planning, and we broadly define a few of these below:

– Grantor Trusts – in this type of trust, the individual who sets it up is the “grantor”. The grantor retains control of the trust and all assets in it, and the grantor reports all income in the trust on their personal tax return during their lifetime. While the grantor may be pushed into a higher income tax bracket by choosing this trust type, the benefits of the Grantor Trust include that the grantor can retain control over the trust and its assets during their lifetime. After the grantor passes away, control of the Grantor Trust is transferred to a “successor grantee” that the original grantor has named to resume control of the trust. This provisioning ensures that the trust assets are distributed to the beneficiaries as the grantor originally determined, and also protects the trust assets from being distributed through the probate process.

– Simple Trusts – this type of trust does not have a grantor, and it is the most straightforward trust type available. Simple Trusts house trust assets during the year, and all trust earnings are treated as if they were distributed to the beneficiaries for tax purposes (even if the income was not distributed). In this type of trust, the beneficiaries are taxed on the asset earnings (income) even if no distributions are made to them, and the original asset balances are not distributable – only earnings are distributable to the beneficiaries. This trust type provides a fairly straightforward platform from which to designate/distribute assets to beneficiaries, and probate is still avoided because there is a designated structure for asset distribution through the trust. When it is time to distribute the trust assets in the final year of the trust, the Simple Trust is converted to a Complex Trust so that it can distribute the asset balances to the beneficiaries in addition to any earnings.

– Complex Trusts – this type of trust fills the space for Simple Trusts that are too advanced to be considered Simple Trusts anymore. To be considered Complex Trust, a trust must do one of three things: distribute a portion (or all) of the asset balances to beneficiaries, retain a portion (or all) of the asset earnings within the trust rather than distributing them to the beneficiaries, or make charitable contributions to qualifying charitable organizations.

– Revocable Trusts – applicable to several trust types, a trust that is revocable includes provisioning for amendments after formation. This means that authorized parties can edit and make changes to Revocable Trusts after they are formed.

– Irrevocable Trusts – the opposite of Revocable Trusts, Irrevocable Trusts do not include provisions for amending the terms. Once an Irrevocable Trust is formed, the trust terms are permanent and no editing is possible.

FORMING AND SELECTING TRUSTS

– Broadly speaking, there are a few aspects to consider when forming a trust:

– Income in the trust – as the trust owner, are you comfortable being taxed on all of the income in your lifetime or would you prefer if the income was immediately taxable to the beneficiaries? If you would like to assume the tax burden during your lifetime, a Grantor Trust may be the best fit. If you would like the beneficiaries to share the tax burden, Simple or Complex trusts may be a good fit.

– Estimated payments – keep in mind that if a trust is expected to owe $1,000 or more in tax, estimated payments are required on the same schedule as individual estimated payments – April, June, September, and January.

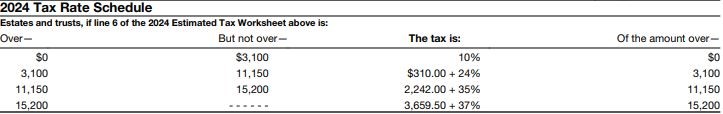

– Current tax rates – for 2024, the highest income tax rate for trusts is 37% and the lowest is 10% (see below chart).

FACTS & CONSIDERATIONS – ESTATE PLANNING

– While selecting and establishing a trust to house your estate assets is the first step to estate planning, we wanted to provide a few considerations for when the trust closes and the estate is passed down to heirs:

– Portability election – when an estate tax return is filed, each individual is entitled to an estate tax exemption based on a lifetime amount. The lifetime amount per person is $13,610,000 for 2024. In the event that one of the spouses passes away and the other does not, the portability election provides a way for the deceased spouse to transfer or “port” the unused portion of their exemption to the surviving spouse.

– The estate and gift tax exemption will sunset at the end of 2025. This means that the exemption will drop to what it was before the Tax Cuts & Jobs Act of around $5,000,000 (not considering inflation), pending further legislation to extend the higher estate and gift tax exemption thresholds.

NEXT STEPS

Estate planning is a process that allows you to manage the distribution of your assets after you pass away. While reviewing the information above on your own is certainly beneficial, we also recommend that you establish a relationship with a trusted financial advisor, along with a tax attorney, who can assist in formulating an estate plan that works best for your individual goals. We are happy to assist with any tax advice you may need related to the types of trusts and what may work best for you.